How to Calculate Hours Worked: Step by Step

Keeping track of employee working hours ensures fair compensation and efficient project management. But how do you calculate hours worked per day, week, or month? You can do it automatically by using a time tracking app, semi-manually by using a Time Card Calculator, or manually by filling in timesheet templates.

There is a simple formula, too, to calculate working hours on paper or using a calculator.

Let’s examine different ways to calculate employee hours worked within a specific time period and how to create timesheets yourself.

Automatically or manually. With a physical time tracker or keyboard shortcuts. Under 1 minute a day.

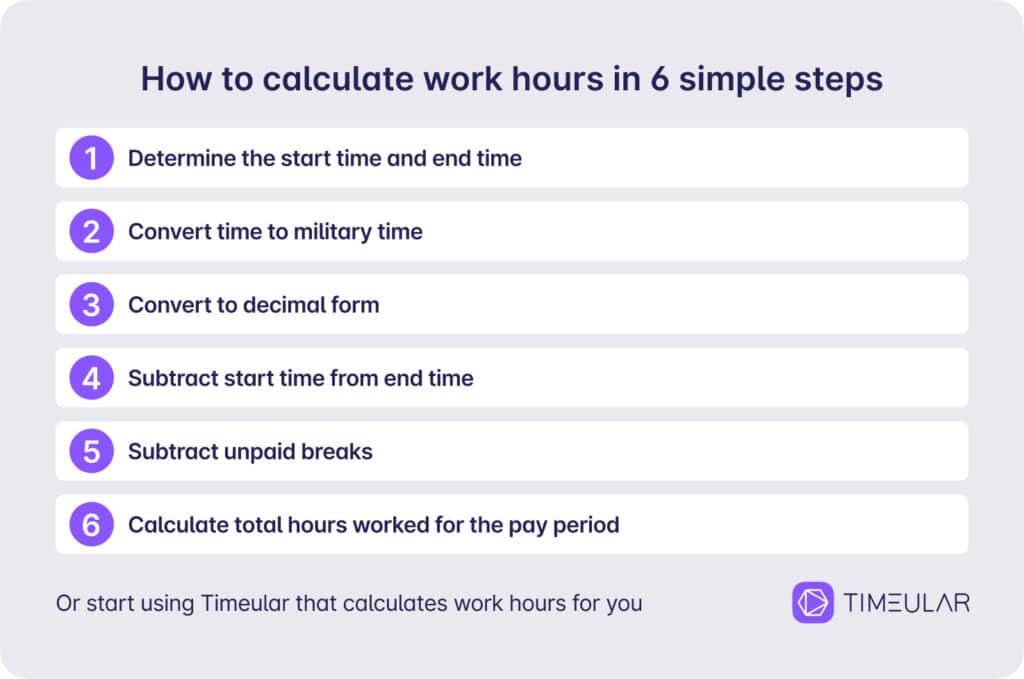

How to calculate hours worked

To calculate hours worked within a specific period, follow these steps:

Step 1: Determine the start time and end time

To calculate how many hours you or your employees worked within a day, week, or month, you need to precisely define the start time and end time of each work day of the tracked period.

This may involve referring to timesheets, job logs, or even using a work hours tracker that provides detailed information about clock-in and clock-out time.

For example: On Monday, John Watson started working at 8 AM and finished at 4 PM.

Step 2: Convert time to military time

Convert start and end times to military time (24-hour clock) to maintain consistency and avoid confusion arising from AM/PM designations.

To convert time to military time, add 12 to the end time (afternoon hours), and leave start time (morning hours) as it is.

For example: As John started work at 8:00 AM and finished at 5:15 PM, you will convert it to 8:00 and 17:15.

Step 3: Convert to decimal form

Since work schedules often involve minute-level precision, and employers use the decimal format to calculate wages, it’s essential to convert the minutes into decimal hours.

To do this, simply divide minutes by 60.

For example: As John finished work at 17:15, divide 15 by 60 to get 0.25. This turns 17:15 into 17.25.

Step 4: Subtract start time from end time

With the start and end times in a 24-hour and decimal format, you can simply subtract the start time from the end time to determine the total work hours.

For example: As John started work at 8:00 AM (08:00) and finished at 5:15 PM (17:00), his total work hours amount to 9:15 hours (17:15 – 8:00 = 9:15). Now, let’s convert this to a decimal form: 9:15 –> 9.25.

Step 5: Subtract unpaid breaks

Unpaid breaks are typically deducted from total work hours to determine the net work hours, representing the actual time spent at work.

This final step is crucial for ensuring that employees are compensated fairly for their actual work hours.

To subtract unpaid breaks, identify the total length of the break and subtract it from the total work hours.

For example: As John worked for 9.25 hours and took a 30-minute lunch break (30/60=0.5), his net work hours amount to 8.65 hours (9.25 – 0.5 = 8.75).

Step 6: Calculate total hours worked for the pay period (week, month)

You’ve already learned how to calculate daily work hours. In order to calculate the total hours worked per week or total time worked per month, add the total hours worked in the particular period using the same formulas.

If you want to calculate employee hours worked per specific pay period, I suggest you switch to a time tracking software that will do it automatically.

Read: How lawyers track billable hours

Benefits and limitations of calculating work hours manually

Creating handwritten timecards is a simple and inexpensive way to calculate hours but it works fine only for those in freelance positions. Unfortunately, it’s not a time-efficient method to calculate work hours for teams.

Benefits:

- No need for training

- Inexpensive to implement

- No additional software required

- Suitable for remote or mobile employees

Drawbacks:

- Time-consuming to record and maintain

- Susceptible to errors and omissions

- Difficult to generate reports

- Not scalable for large teams or complex projects

Overall, handwritten timecards are a viable option for businesses with small teams or simple payroll needs. However, they are not the most efficient or accurate method of tracking employee hours. Businesses with larger teams or more complex payroll needs should consider using a work hours tracker.

More time-efficient methods to calculate work hours

Time tracking apps

Time-tracking software automates the process of tracking and calculating the time spent at work, on different tasks, projects, or clients. There is no more need for paper timesheets, and all employee timecards are always at hand, available within one software.

Benefits:

- Smooth time reporting system

- Automated time tracking and user-friendly time tracking methods:

- Automatic tracking of non-billable and billable hours

- Tracking time spent on projects and tasks

- Tracking breaks

- Calculating overtime hours and overtime pay

- Integrations with calendars, project management tools, and HR software

- Can be used on desktop, mobile, and web

- Perfect for on-site and remote teams

Drawbacks:

- It needs basic training

- There are both paid and free options available

Some of the most popular and efficient time management tools include Timeular, a simple, smart, and secure time-tracking software that allows you to accurately track time spent on tasks without disrupting your workflow.

Spreadsheets

Are you a spreadsheet fan and want to use Excel or Google Sheets as your hours calculator? Why not! I’ve created a couple of free timesheet templates that you can use to calculate hours worked in Excel or Google Sheets:

Benefits:

- Flexible and customizable

- They can be used to track multiple projects and tasks

- It’s possible to generate reports and invoices

- They can be shared with multiple users

- They can be used on desktop, mobile, and web

Drawbacks:

- They can be time-consuming to set up and maintain

- Prone to errors

- Not user-friendly, messy, and clunky

- Not as secure as dedicated time tracking systems

Spreadsheets are a viable option for businesses with small teams or simple payroll needs. However, they are not the most efficient or accurate method of tracking hours worked. Businesses with larger teams or more complex payroll needs should consider using a solution such as a time tracking app.

Learn more:

Time clocks

Time clocks are physical devices that employees use to clock in and clock out of work. They are a more reliable and accurate way to track hours than handwritten timesheets, and can also be used to track breaks and overtime.

Benefits:

- More reliable and accurate than handwritten timesheets

- Tracking breaks and overtime hours

- Integration with payroll systems

- They can be used with a variety of scheduling systems

Drawbacks:

- They can be expensive to purchase and install

- They require additional maintenance

- Not as portable as time-tracking apps

- Not suitable for remote or mobile employees

Time clocks are a good option for businesses that need a reliable and accurate way to track hours and might work well for businesses with a large number of employees or complex payroll needs. However, businesses with remote or mobile employees should consider using a time-tracking app instead.

Online time clocks

Online time clocks allow employees to clock in and clock out using computers or mobile devices. This method is more accurate and efficient than manual timesheets but it requires additional software and infrastructure.

Benefits:

- More accurate and efficient than manual timesheets

- Can track breaks and overtime

- Integrate with payroll systems

Drawbacks:

- Requires additional software and infrastructure

- They may not be suitable for all businesses

- They can be expensive to implement

Integrated payroll systems

Integrated payroll systems combine time tracking with payroll processing. This eliminates the need to manually enter time into payroll software.

Benefits:

- Eliminates the need to manually enter time into payroll software

- Improves accuracy and efficiency

- One tool to cover multiple needs

Drawbacks:

- Requires a more expensive payroll system

- They may not be suitable for all businesses

- Requires training

Read also: Why time management is important in a business

Automatically or manually. With a physical time tracker or keyboard shortcuts. Under 1 minute a day.

FAQ

How to define work hours and overtime?

The definition of work hours can vary based on employment contracts, industry standards, and local labor laws.

- Regular work hours refer to the standard timeframe during which an employee is obligated to be present and perform job-related duties;

- Overtime occurs when an employee works beyond their regular work hours. To calculate a one-time overtime event, use the free overtime calculator. To track overtime regularly and automatically, try the Overtime Tracker.

- Part-time work involves an employment arrangement where an individual works fewer hours than a full-time employee, often less than 35-40 hours per week.

Understanding these distinctions is crucial for both employers and employees to make sure you are compliant with labor laws, appropriate compensation for overtime, and fair treatment for part-time workers.

How to calculate overtime pay?

Overtime pay usually exceeds regular hourly pay rate. For example, in the United States, overtime pay is typically calculated at 1.5 times an employee’s regular hourly rate for hours worked beyond 40 in a workweek.

Remember that the specific rules for overtime pay can vary based on employment agreements, employee classification, and jurisdiction. Certain states may have distinct overtime thresholds or rates, and some industries may have unique regulations.

Learn more in the article how to calculate overtime pay.