Months with 5 weeks 2025: How Employers and Employees Should Prepare

You must have noticed that some months feel longer than others. It’s not just your imagination. While most months have four complete weeks, some months have 5.

In 2025, there will be 4 months with 5 weeks: January, May, August, and October, and it will impact all stakeholders, from employees to businesses. Dive into this article to discover how each stakeholder is impacted and how to plan for that.

Why do some months have 5 weeks?

First up, in order to understand why some months have 5 weeks, you need to take a closer look at how weeks and months intersect. Most months have 30 or 31 days, except for February, which has 28 (or 29 in a leap year). But 28, 30, and 31 don’t divide evenly by 7. This means that each month doesn’t align perfectly with a 4-week timeframe.

The “extra” days accumulate until a month ends up with parts of 5 different weeks in it. On average, this happens about four times per year. A month will have 5 weeks anytime it starts early in one week and ends later in the 5th week. For instance, starting on a Friday and ending on a Sunday.

Note: If you’d like to understand the concept of a leap year, I’ve defined it in another article called How many work days there are in a year.

Months with 5 weeks in 2025

In 2024, the months with 5 weeks were March, May, August, November. Now, for 2025, the months with 5 weeks will be the following:

Let’s look at exactly when this will occur in 2025.

In 2025, the following months will have 5 weeks:

1. January (starts Wednesday, 1/1, ends Friday, 1/31)

2. May (starts Thursday, 5/1, ends Saturday, 5/31)

3. August (starts Friday 8/1, ends Sunday 8/31)

4. October (starts Wednesday 10/1, ends Friday 10/31)

How does a 5-week month impact an employer?

5-week months affect work schedules, capacity planning, and budgets in a fiscal year, as it shifts when the regular payday falls in a month. As an employer, you need to factor in the following:

1. Payroll and budgeting

One of the most immediate impacts of a five-week month is on payroll and your monthly pay schedule.

If you have hourly employees, you’ll pay them for an extra week of work in those months. Even if your team’s hours don’t change, that extra paycheck period can add up, especially if you have a large hourly workforce. For employees, the monthly income won’t necessarily come with a change in their paychecks, but it’s still an extra pay period you need to account for in your budget as a business.

That’s why you need to budget proactively and factor in those four five-week months when you’re creating your annual budget. Allocate extra funds for payroll in January, May, August and October. This way, you’ll avoid a last-minute crisis in cash flow management.

Related resources on payroll management and tracking:

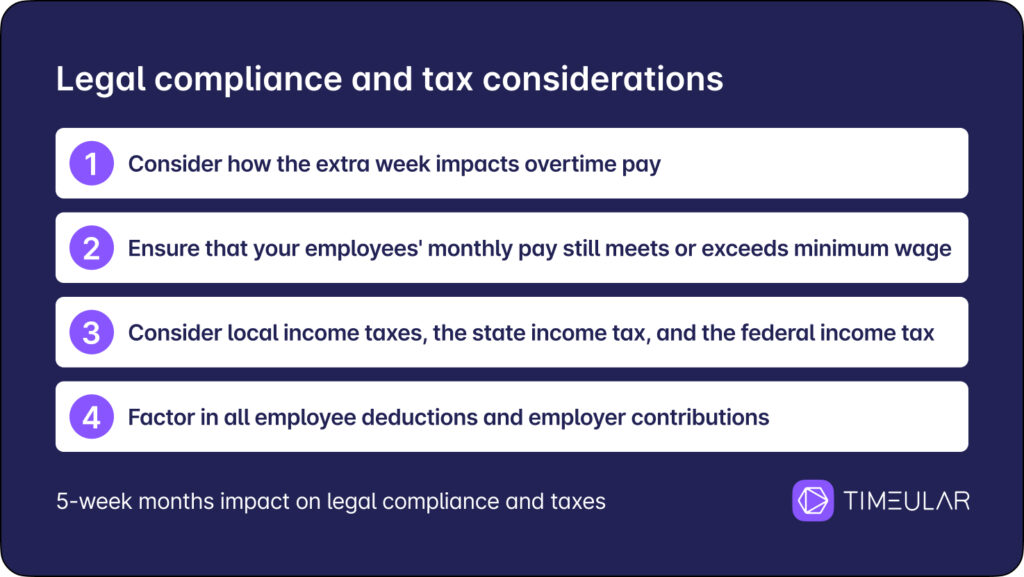

2. Legal compliance and tax considerations

While you’re adjusting your budget for five-week months, it’s also important to ensure you’re staying compliant with all relevant labor laws and tax regulations. This is especially important if you have hourly employees who are now working (and earning) more in those months. In order to stay compliant, account for the following:

Overtime pay

First, consider how the extra week impacts overtime pay. In this case, the Fair Labor Standards Act (FLSA) asks that employers pay half and one time of regular rates of pay in a 40-hour week. With an extra week in the month, some employees may end up working more overtime than usual. Make sure you’re properly tracking and compensating for those hours.

Minimum wage

A longer month also means more hours worked in total. Ensure that your employees’ monthly compensation still meets or exceeds minimum wage requirements, even with the additional week.

Payroll taxes

From a tax perspective, five-week months mean extra paychecks to account for. Generally, this affects your tax deposits, as you need to consider local income taxes, a state income tax, and the federal income tax. Your accountant or payroll provider should be able to clarify what the Federal Insurance Contributions Act (FICA) requires from employers and how much taxes you’ll need to factor in.

Track work hours, overtime, and leave in a single app, and create comprehensive reports with a few clicks.

Benefits administration

If you offer benefits like health insurance or retirement plans, consider how a second or third paycheck impacts your monthly cash flow. Factor in all employee deductions and employer contributions and potentially benefit administration processes for those months.

Project planning and scheduling impacts

Beyond the financial and legal considerations, five-week months also impact your project planning and scheduling. If you’ve scoped out a project based on a standard four-week month, that extra week will be a detour. You need to recalculate your plan, and these additional weeks can be used for the following:

- Take on an extra project or client

- Tackle a strategic initiative you’ve been putting off

- Give your team some breathing room to perfect their work

- Invest in professional development or team building

How to plan for 5-week months (as an employer)

There are other implications for a business, but these are the most important. However, in order to stay on top of all these changes, payroll schedules, capacity planning, and compliance, all processes related to these changes must be automated.

Here’s what a payroll tracker can help with:

- Payroll schedules and budgeting: A timesheet app tracks employee hours automatically for payroll reports and shows you real-time visibility into project budgets based on the actual hours worked.

- Legal compliance and tax considerations: The work hours tracker alerts you when employees are approaching overtime thresholds to help you manage costs. Moreover, it gives you the records needed for compliance.

Such time trackers are integrated with payroll and accounting tools.

- Project planning and scheduling impacts: Project time tracking is integrated into such tools, and even if you might have scheduled projects wrongly, you receive visibility into team capacity and utilization across projects in real time. This way, you’re able to forecast future projects.

Track work hours, overtime, and leave in a single app, and create comprehensive reports with a few clicks.

Impact on employees

As an employee, you get to experience both benefits and drawbacks. Therefore, you need to plan in advance if you get extra money, if you’ll be saving money or directing it toward a holiday, and most importantly, keep your work-life balance in check. Here are some of the implications you’ll have in 2025:

1. Income fluctuations for hourly employees

A five-week month essentially means an extra paycheck if you’re paid weekly or monthly by the hour.

You’ll be working (and earning) for an extra week compared to a typical month. The extra income in your bank account can be a nice bonus. But remember, there’s an additional week’s regular expenses added to your monthly expenses. It’s wise to allocate it thoughtfully and not take the extra paycheck as “free money.”

Some things to consider here are:

- Start building an emergency fund, a savings account for tough times, or even a retirement savings account. This way, you ensure financial stability for yourself and your family.

- Invest in your long-term financial goals. Be it a trip to the Island, buying your own house, or any other dream, those usual two paychecks have now turned into three paychecks, or even more can make it possible.

- Cover upcoming large expenses with your bonus money. If you know you’re renovating your house or planning to change your job, put the money from the extra paycheck months aside.

2. Impact on salaried employees

If you’re a salaried employee, your paycheck likely won’t change in a five-week month. However, you may feel like working “extra” days for the same pay. This can be mentally challenging and can feel unfair, especially if your workload increases to fill the extra time. It’s important to manage your energy and avoid burnout during these longer months.

One strategy is to use the extra days for activities that benefit you professionally or personally. You could:

- Tackle a project you’ve been wanting to work on. Maybe you’ve been dreaming of starting a blog to share your expertise or experiences. Use the extra days to brainstorm topics, outline your first few posts, and set up your platform.

- Learn a new skill related to your job. Start learning how to handle AI to your benefit and do your job faster than you did before.

- Attend a conference or workshop. Look for conferences or meetups focused on your industry or interests. Informal gatherings can be a great way to connect with like-minded professionals and level up your career.

- Take a day off for mental health or personal errands. This could include things like a nature hike, a spa treatment, a yoga class, or curling up with a good book.

3. Benefits and deductions

If you have benefits like health insurance or retirement plans through your employer, it’s important to understand how a five-week month impacts your deductions and contributions.

- In some cases, your employer may adjust your deductions to spread them out over the extra pay period. This could slightly reduce your take-home pay for that month.

- On the flip side, if you’re contributing to a 401(k) or other retirement plan, the extra pay period could mean more money going toward your long-term savings (especially if your employer offers a match).

Be sure to review how different payroll schedules impact your pay and talk to your HR department if you have questions about how your benefits are impacted by a five-week month.

Start your 2025 work plan

Both as an employer and an employee, you need to proactively adjust plans and decide about the timelines of your projects and workloads to the new schedule before the end of each year.