Block Billing: Benefits, Risks, and Smart Implementation

As legal professionals, you’re already aware of the struggle to bill accurately while juggling cases and client demands.

Block billing might seem like an appealing solution to streamline your billing process. But before you decide if it’s right for your practice, let’s explore what block billing really means and if it’s worth implementing it.

What is block billing?

Block billing is a method of tracking billable hours in which you consolidate multiple tasks into a single timesheet description and bill them in an entire block. The opposite of that is granularly tracking each task that accounts for the billable time of client work in your timesheet app and invoicing it.

For example, instead of separately adding on your multiple activities like “Email to client (0.2 hours), Legal research (0.5 hours), and Invalidity claim chart (1.3 hours),” a block-billed entry could be “Admin legal work (2.0 hours).”

This approach with consolidated hours billed and time entries is often debated in the legal industry where detailed billing practices directly impact client relationships and payment processing.

Benefits of block billing

Block billing comes with several advantages that make it attractive to professionals. Let’s explore some of them:

- Reduced administrative burdens: When consolidating multiple related tasks, you’re streamlining the billing process, reducing the time spent on every single time entry, and potentially decreasing billing-related errors caused by frequent context switching.

- Natural workflow: Block billing can reflect how someone actually works, as tasks often overlap throughout the day, and it’s easier to group them in blocks. When researching a legal issue, for instance, a lawyer might simultaneously review documents, draft sections of a motion, and discuss with other team members – activities that naturally flow together.

- Better resource allocation: It’s easier to manage resources and reallocate them when you are not consuming time to report each task of work performed for a client, as you’re allowed to handle multiple tasks and projects simultaneously.

Challenges and risks of block billing

Block billing is a highly disputed topic in professional and legal services. Some practitioners swear by its efficiency, while others criticize its lack of transparency. For example, in a subreddit on the topic of block billing, here are some comments on block billing:

It’s all about visibility and accuracy. Block billing hides how much time and money was spent on particular tasks. The client has no way to know. Reddit participant

The guy managing the out-house legal budget has to explain these large bills to someone who asks “why did it cost this much?” Much easier if you say, “here are their bills” than “this is what we agreed to pay.” Reddit participant

Here are some specific drawbacks of block billing:

- Increased risk of under-billing or over-billing: With block billing, law firms increase their risk of under-billing or over-billing clients, as the time spent on client work is estimated rather than precisely calculated and invoiced. Therefore, they might invoice unreasonable amounts and this makes it hard for clients to audit and verify billing accuracy.

- Risk of client objections: Many clients, particularly more complex ones with detailed billing guidelines, explicitly prohibit block billing. They argue that block billing hides the true time spent on individual tasks and makes it difficult to assess the value of services offered. Therefore, law firms can expect more client objections.

- Billing disputes: When time entries lack granular detail, clients may challenge the accuracy and how reasonable your fees are. This can also lead to payment delays or write-offs. This lack of transparency often strains client relationships and complicates the collection process.

- Automatic reductions: Some courts and clients automatically reduce block-billed time entries by a preset percentage (often 10-15%), as they view them as inherently less reliable than detailed time entries. Some clients even refuse to work with firms that use block billing – you can find more context in the subreddit I’ve mentioned.

Let automated time tracking capture every task in real-time, while you focus on what matters – practicing law.

Implementing block billing effectively

If you’re deciding to implement block billing despite its risks, you should know that for good billing hygiene, it’s best to apply some practices to maximize its benefits while minimizing potential issues:

Review client guidelines before implementing block billing

Start by carefully reviewing your clients’ billing guidelines. Many institutional clients, particularly insurance companies and large corporations, have specific requirements regarding time entry format and may reject block-billed invoices. If you already have some clients in your records, review all interactions with them and their contracts to understand if it’s a good move to start applying block billing or if you’re jeopardizing your success.

Set clear internal policies for block billing

Establish clear guidelines for your team about when block billing is appropriate and how to structure time entries effectively. An example is setting a maximum time limit for block-billed entries (e.g., no more than 3 hours) to keep reasonable transparency. Think of all the details of billing for your clients and everything that could be left out by your team and disputed by your clients. An example could be the notes or descriptions of each time entry.

Consider implementing guidelines such as:

- No more than 3-4 hours per block entry

- Separate blocks for morning and afternoon work

- New blocks when switching between different matters

- Clear delineation between different types of legal work (e.g., keeping court appearances separate from office work)

Use a time-tracking tool to protect yourself against disputes

Even if your main way of invoicing your billing partner is with block billing entries, it’s best to always have evidence of how much time is spent on each task with granular detail. This is especially crucial when working as outside counsel for larger corporations, where billing scrutiny is more rigorous. It’s also helpful both in improving your operations and spending less time on administrative tasks over time and also in having a backup in case your clients start a dispute.

An automated time-tracking tool does all the monitoring for you, from automatically capturing all work done for clients to sending detailed reports with the work. Ultimately, you can privately track detailed time entries for internal reference and generate client-facing block-billed invoices.

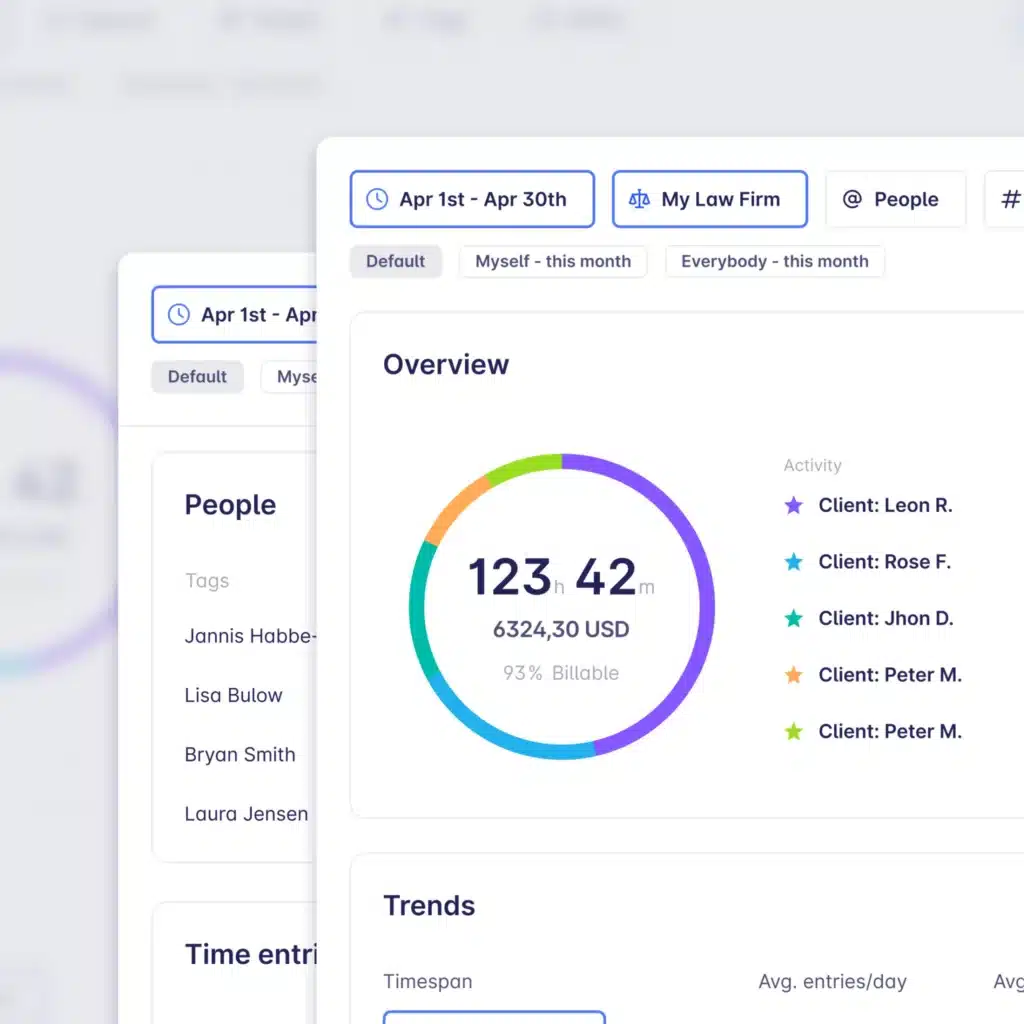

Let’s take an example of a time-tracking app (Timeular, in this case), and see what it can do for your law firm:

- Automated time entry generation: The app captures daily activities automatically, recording time spent on different apps, documents, and websites. This means when you’re reviewing case files, drafting documents, or doing legal research, every minute is captured without your manual intervention. You can later review this data and quickly convert it into formal time entries with a single click.

- Effortless billable hours tracking: In Timeular you can track billable hours automatically, without any need for manual time logging. Attorneys can instantly mark tasks as billable or non-billable with a single click, while the app automatically stores billable hours in the background, reducing administrative overhead and ensuring no billable time goes untracked.

- Real-time dispute protection: Keep up-to-date records of all activities as they happen, rather than trying to reconstruct time spent after the fact. If a client questions a block-billed entry, you can quickly reference the detailed breakdown of how that time was actually spent in Timeular.

- Comprehensive rate management: Set specific hourly rates for different types of legal work, clients, or matters. The system automatically calculates earnings as you track time, providing real-time insights into revenue generation across different practice areas and clients.

- Integration with legal software: Seamlessly connect with popular legal practice management tools, allowing you to keep your existing workflow while adding an extra layer of time-tracking precision. This integration means you won’t need to duplicate entries across multiple systems.

- Automated backup storage: All detailed time entries are automatically stored securely, creating an audit trail that can be accessed if needed to support block-billed invoices. This means you’ll always have supporting documentation readily available.

Automated time tracking gives you a detailed backup of every minute spent on client work – while letting you keep the simplicity of block billing.

Keep task-relatedness in block billing

When you’re block billing, group only related tasks that naturally flow together. Avoid combining disparate activities that could raise questions about the reasonableness of the actual time spent on each task.

For example, if you’re working on a specific case, you might group “reviewed case documents, drafted motion for summary judgment, and conducted legal research on precedent cases” as these are all related to the same legal matter. However, avoid combining unrelated activities like “attended client meeting for Case A, reviewed documents for Case B, and drafted an email for Case C” as this creates confusion and may raise red flags with clients.

Document while you work, not later

It’s easy to forget what you’re working on by the end of the day, let alone by the end of a week or month. Make a habit for yourself to note specific tasks even if you plan to block and bill them later.

This will serve you two purposes: it provides backup documentation if clients request details about the work performed, and it helps you accurately recall the full scope of work when preparing invoices.

Conclusion

Block billing, when implemented thoughtfully with the right tools and processes, can streamline your legal practice’s administrative workload without compromising client trust or billing accuracy. The key lies in finding the right balance: using technology to maintain detailed records while presenting simplified bills, establishing clear internal policies while staying flexible to client needs, and leveraging automated tracking while preserving the natural flow of legal work.